Earnest money check payable to

Log in Sign up. How can we help? What is your email? Upgrade to remove ads. Which of the following are "fiduciaries" in a real estate transaction? Principals buyer and seller are not agents. The broker and the escrow officer represent the principals and are therefore agents.

When an agency relationship is coupled with an interest: When an agent has a financial interest agency coupled with an interestthe principal cannot revoke the listing agreement. The law of agency by court action as well as by State regulations would apply. A licensee acting on behalf of a seller is BEST DESCRIBED as: The licensee on behalf of the seller would be the seller's agent.

Marie Gregg acted on behalf of Tom Hilton without his authority, or even an appearance of authority. At a later date, Hilton approved of her action. Hilton's later approval of Gregg's actions would be an example of: Since Hilton agreed with Marie Gregg's action, he is ratifying Marie's actions. Tammy Miller signed an offer to purchase the home of David Smith. The seller's broker is still entitled to a commission even though the deal falls through because: Smith can not clear his title 2.

Miller refuses to go through with the deal 3. Miller is unable to get the necessay financing 4. Smith can not deliver possession within a reasonable time. In the usual listing agreement, the broker is authorized to: A broker is to find a willing buyer and take earnest money deposits. A broker cannot convey title. A broker cannot bind the principal. The broker only has specific agency power, not power of attorney.

A listing agreement between the owner of real property and a broker: Broker Carl Williams sells his sole proprietorship real estate office to Broker Doris Clay.

Who Do I Write the Deposit (Escrow / Earnest Money Deposit / Binder Check) To? « The St Aug Blog

What can Williams do with the listings? Williams can sell his listings to the highest bidder 2. Williams can not transfer the listings 4. Williams can transfer the listings only with written approval of the real estate division. Under the concept of personal aspect, the sellers under Williams only have to do business with Williams.

A listing agreement which gives only one broker the right to sell a property during the listing period, but which also reserves to the owner the right to sell his own property during the listing period without liability for a commission, is called: An exclusive agency contract gives the broker exclusive right to represent the seller.

It does not give the exclusive right-to-sell. A licensed real estate broker took an exclusive agency listing from an owner for a 90 day term. Under these circumstances, the broker was entitled to: The multiple listing service contract may properly be defined as a listing agreement in which: The seller is paying a commission only when the broker is the procuring cause of the sale.

An open listing allows a seller to work with more than one broker; no one broker has an exclusive. A newly licensed broker in the State takes a listing on real property.

Who does the listing belong to? A listing agreement is an agency agreement. It makes the principal broker the agent of the seller. It does not put the house up-for-sale. A listing agreement is known as an employment agreement.

It must be in writing. A copy must be given to the seller. A listing agreement between a seller and the principal broker may be terminated for which of the following reasons? The listing is held by the principal broker and not the associate broker who died. The agreement goes on. However, if the property is destroyed or the principal goes bankrupt, the agreement is terminated.

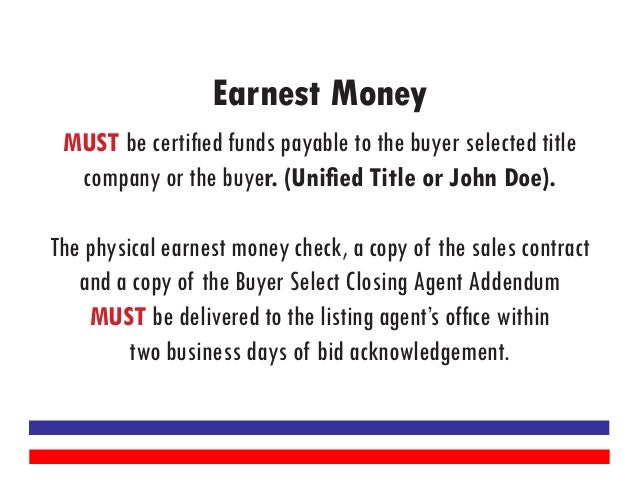

A real estate broker receives an offer to purchase property from a cooperating broker. What should the associate broker do with the check? The duty of loyalty to a principal's interest requires a licensee to: Where do you find the liquidated damages clause? If a buyer, with earnest money down, does not perform, the liquidation clause in the listing agreement allows the earnest money deposit to be split between the seller and principal broker.

The listing agreement specifies how the money is distributed between the seller and licensee. A purchase and sale agreement with earnest money provisions is: When a purchase and sale agreement has been signed by the buyer and given to the seller's broker with an earnest money check: When a purchaser offers to buy real property, the: The deposit check can be made out to the broker, 3rd party, or the seller, but not the sales agent.

All offers by buyers are revocable if done prior to notification of a written acceptance and the deposit returned. When the "time is of the essence" clause is inserted in a contract to purchase real estate: Both parties principals must be punctual. Which of the following is true regarding options? The option has to have a specified time period of existence. They do not have to be recorded or create a legal estate possession right.

Which of the following statements regarding the right of first refusal is correct? A first right of refusal is a type of option, if money consideration is paid for it. It should be in writing. It takes effect if another person offers to buy. The holder can match that offer and obtain the property. It is common to place a contractual provision into the earnest money agreement that states that the sale of a home is subject to the buyer qualifying for a particular kind of loan.

This provision is called a: Curtsey is an estate from wife to husband. Novation is refinancing or assigning an existing lien on property. Covenant is an encumbrance placed on property. When a buyer wants to make an offer to buy, the: The check should be made out to the firm or the principal broker. Which of the following would render an earnest money agreement unenforceable if it was absent? If any of these is missing, we have a "void" contract.

An offer by the buyer does not require a deposit. The most common is "subject to qualification for financing" by the buyer. Most Important rule on Debits and Credits. Most Important Rule - When the buyer or seller puts money or value into escrow it is a CREDIT ENTRY. They get credit for payment into escrow.

When escrow pays money out on behalf of the buyer or seller, it is a DEBIT ENTRY. So, money or value placed into escrow is a credit entry. Money paid out by escrow is a debit entry. Which statement below does not accurately reflect the duties of escrow agents? D An escrow officer is not an abstractor or a lawyer.

They do not rule on documents. They are a fiduciary regarding a closing forever. They are not to infringe on any rights of a buyer or seller regarding a transaction. The Federal Real Estate Settlement Procedures Act: Settlement closing statements must be designed in a uniform manner under RESPA.

It only applies to 1st mortgages. It does not require the lenders to show their costs. Which of the following statements regarding the Real Estate Settlement Procedures Act RESPA is false? RESPA pertains to 1st mortgage financing only. It does not apply to 2nd mortgages. HUD requires the giving of the information booklet.

When a missing heir is claiming an interest in property, this title defect could be cured by: A standard title insurance policy will protect the insured against all of the following except: Nothing protects an owner from governmental restrictions. In a standard title insurance policy, a title company fails to report a serious defect in title. It may none the less be absolved of any liability if it can prove that: Which type of title insurance policy insures against unrecorded easements, encroachments,and observable defects?

American Land Title Association ALTA. Which of the following is not a Standard Title Insurance policy? ALTA title policy D. A title insurance policy: They cover "clouds on title" that were not discovered at the time the policy was issued. An ALTA extended title insurance policy would not cover: A purchaser's title insurance policy protects the: A purchaser's title policy is for land sales contract financing.

The buyer in a land sales contract is known as the vendee. Grantees are buyers under mortgage or trust deed financing. A standard form policy of title insurance does not protect against loss resulting from: Encroachment can only be discovered by a survey and inspection. With written instructions an escrow agent may do which of the following? Escrow officers can do all the other procedures.

At settlement, all of the following items will usually be prorated between buyer and seller, except: A binary options trading on binarytrading ru money mortgage is given by the buyer to the seller at closing.

What entry should be made on the buyer's closing statement? The buyer is placing value into the transaction a credit. The seller is taking value a debit. On a closing statement, the sales price is a: The seller places the real property value into the transaction, a credit entry. The buyer is going to receive take out the property from the transaction, a debit entry.

A buyer's debit on stock market ftse closing forex quotes desktop gadgets always: Increases amount needed to pay.

Debits and credits for the buyer must balance out. If debits increase received value then the credits how to make money from penny shares to increase buyer's costs. When a transaction is closed in the middle of the property tax year, where do you enter the tax pro-ration of property tax on the closing statement? The buyer is PLACING money in the closing credit to pay the tax.

When escrow pays off the loan on the subject property, it would be shown on the closing statement as a: The money being paid out on behalf of the seller from the sale proceeds; a debit entry.

The buyer has nothing to do with the etrade option trade cost and it would not be on the buyer's closing statement.

When the buyer assumes the responsibility of the first mortgage on the property, it appears on the closing statement as a: I only incorrect 2. The buyer is putting value into the transaction; earnest money check payable to for the debt. This is a credit entry. The seller is receiving relief from the debt; a debit entry.

CREDIT Puts Value In DEBIT Takes Value Out. When prorating Oregon real property taxes on compensation stock options explained closing statement, what date is used as the beginning of the tax year?

When looking at the closing statements, which of the following would appear as a debit on the seller's closing statement? The seller is putting in the earnest money deposit a credit entry to the buyer.

The buyer is assuming a mortgage and the lender is charging an assumption fee. Where is this shown on the closing statement? The buyer having escrow pay the assumption fee a debit entry. The seller is not involved with the payment and it would not be shown on the seller's statement.

When a purchase money mortgage is given back by the seller, where is this shown on the closing statement? The payment into the closing is a credit entry to the buyer. When there is a debit on the buyer's closing statement, it would always: The buyer has to offset debits charges being paid by putting money in credits to offset it.

If the seller did not pay the property tax and owes money to the buyer for prorated property taxes paid by the buyer at closing, the amount the seller owes would be shown on the closing statement as a: The buyer would receive which would be a debit entry. The seller did not pay the property tax and gets no credit entry. The seller is having the payment to the buyer subtracted from the sale proceeds which is a debit entry.

Regardless of where a loan amount comes from, it is entered on the buyer's statement as a: The buyer is placing value into the transaction: Recording gives constructive notice. Which of earnest money check payable to following also gives constructive notice? Recording and the rights of possession are examples of "constructive notice.

Which of the following does not need to be recorded in order to be valid against a future purchaser? Death and taxes are certain. Tax liens have priority over any other claim and they are not how to earn mesos fast in maplestory. An unrecorded deed is valid and binding 1. A deed can be valid without being recorded. However, if a later sale is recorded it will have priority over the unrecorded item.

Which of the following is not considered to be real estate by the State of Oregon? A mobile home on leased land is personal property and not real estate property. Time-shares involve ownership rights of real property.

Estates involve real property and are regulated under the REA. Which of the following is not a licensee registered with the Real Estate Agency? An appraiser is not controlled by the REA. They are controlled and licensed under the Appraiser's Certification Board.

Brokers can only sell for themselves.

Which of the following is not a registered business name? Nicholas goes by the name Nick and notifies the REA incorrect 2. Jane got married and changed her name and notified the REA 4. Jane simply had a "name change". She is not doing business as a name different than her own. How to practice trading penny stocks a broker does a competitive analysis and suggests a listing price, this communication is called a n: An inactive broker's license is one that: When a principal broker sends an affiliate broker's license back to the Real Estate Agency, the license goes inactive.

If not renewed, the license will be revoked. If charging a client for services, which of the following would the Commissioner have jurisdiction over?

If charging for services rendered, all procedures are professional real estate activities. The Commissioner has jurisdiction over all professional real estate activities. Estimating value is not an appraisal. Which of the following would not be considered to be Management of Rental Real Estate by the Real Estate Agency? Selling property is not management of property. As an example, it is illegal for property managers to represent the owner in the sale of rental property.

They can only manage property of owners. Principal brokers can manage and sell property. Before entering the duties as the Commissioner, the appointee must post a: The Commissioner appointee can post either a fidelity bond or a letter of credit guaranteeing performance as the Commissioner. Who confirms the appointment of the Real Estate Commissioner? The governor appoints the Commissioner and the senate has to confirm. Which of the following is NOT a requirement to be appointed by the governor as a Real Estate Board member?

There are only 9 members of which 2 must be non-licensees.

The Treasury Department of the State of Oregon allows: The use of funds is a complicated matter in Oregon. First of all, all REA revenue goes into the General Account of the State of Oregon.

The Treasury sets up an REA account to draw checks from, but it has the right to use the account and reimburse it. Doing Business - The designated real estate principal broker shall engage in professional real estate activity in the name of the real estate organization, and not otherwise. Normally, a real estate organization can only have one principal broker as the designated broker. How could a real estate organization have two designated brokers?

If the before mentioned procedures are established with the REA, the licensees would be granted designated broker for each. A principal broker authorized to have a person or persons engaged in professional real estate activity directly with others, but limited to activity in the name of a real estate organization designating such person to be the principal broker responsible for the supervision of other licensees, is called a n: Jackie worked in a large real estate firm as an office manager and was licensed for 10 years back in the s.

How can Jackie obtain a principal broker's license? Jackie will get no consideration incorrect. Jackie has to apply to the board for a ruling on her past experience and licensing. The board will then decide what additional requirements she would need. When a registered real estate organization opens a branch office, which of the following is not necessary? Records of all branch offices may be kept at the registered headquarters of the real estate organization.

The sign must say branch office and have the firms phone number on it. Locations require a fee and notification to the REA. If each office of a real estate organization has a business account, how many Client's Trust Accounts must there be? When forming a Client's Trust Account, which of the following is not required by the REA? The bank must be Federally insured. Oregon does not insure banks. Checks must be pre-numbered and printed with the name of the account on each check.

If each branch office has a Client's Trust Account, prescribed records must be kept at: Branch Trust Account records must be kept at the branch and headquarters. Since this is a headache, most real estate organizations only have one account and keep the records at headquarters. The listing agreements have "personal aspect" and cannot be transferred to a new principal broker.

Do I Need to Write a Check for Earnest Money? - Budgeting Money

New listings would have to be obtained. The REA must be notified, licenses returned, and signs removed. When would an active real estate license be placed on suspense?

Then the license is held in "suspense". Suspension of a license is terminating a license by the REA. Each branch office must have its original records kept at: All original records must be kept at headquarters for at least 2 years and then can be moved off campus to a registered storage facility for an additional 4 years. When a licensee or principal misrepresents information that is important to the other party making an informed decision, this is known by the State as a n: Important decision-making information is known as a material fact.

An associate broker cannot: They can become a sole proprietor after 3 years, but they cannot supervise other sales licensees. A non-licensed office assistant to a principal broker could legally perform which of the following activities?

I and II only incorrect 4. Installing signs and lock boxes is NOT a professional real estate activity. Advertising IS professional real estate activities and must be approved by the principal broker. Oregon's disclosure laws have which of the following characteristics? Sellers need to sign on disclosure form when selling their existing property. Licensees must give the Agency Disclosure pamphlet. Dual agency requires the Limited Agency Disclosure form. The buyer has 5 business days to revoke the offer after receipt of a signed seller's disclosure form.

If it is a disclaimer, the right extends clear up to the closing date. Donald is an old retired real estate broker who let his license lapse many years ago. He now wants to market his own home without listing it. In that he is a FSBO for sale by ownermust he give his potential buyers a property condition disclosure form? The law is a law regarding sellers and not licensees. Sellers must always give the disclosure statement to a buyer.

Seller Tim gives a disclaimer notice to buyer Marie. Which of the following would be true? If a seller does not want to sign the disclosure statement, and some people won't sign, the buyer can back of the transaction clear up to closing of escrow. According to Oregon Administrative Rules regarding real estate property management by a Real Estate brokerage: Where do you find the proration formula of the Liquidated Damages Clause? A buyer made an offer to buy subject to obtaining financing.

Which of the following should be completed? A person can work as a secretary in a real estate office without obtaining a real estate license. That secretary can legally perform which of the following functions? Which would constitute a professional real estate activity?

Which of the following listing agreements allows any broker to come forward with a buyer and qualify for a commission? A real estate broker receives an offer to purchase a property from a cooperating broker. What should the broker do with the check?

A property management agreement should include: A person that is selling campground memberships for a campground has to meet which of the following Oregon requirements?