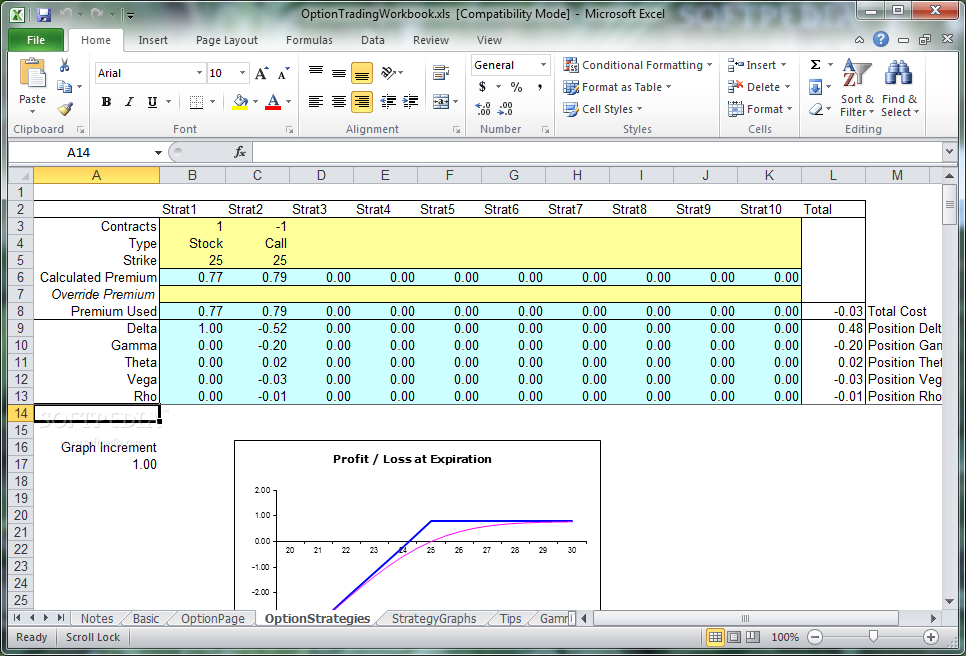

Option trading worksheet

The above example is an early version of a trade log that I set up in Exel. It tracks the essential items I mentioned. The one thing that any analysis tool like this needs is a point of reference.

Ideally I am risking the same amount by percentage each time. The win ratio is calculated by taking the total number of successful trades and dividing by the total.

This number could also be considered the probability of having a winning trade. My initial thought was that I could have a successful trade that lost money if I felt I successfully followed my trading rules. I've since eliminated this column and have gone with a simple measure of success. My trade is successful when it makes money and a failed trade when it loses money. What this tells me is for each trade, what my gain amount is as a percentage of the total risk.

This total risk amount should be roughly equivalent to the percentage amount I was willing to risk i. So, another way to think about this number is my return on risk as a percentage. A lower number doesn't necessarily have to be a bad thing. Ideally the expectancy will be positive for my option trading system. A casino will typically have a negative expectancy. If my expectancy is negative or very low over a reasonably large number of trades, it's time to come up with another system. Expectancy can be calculated using a somewhat complex formula I'll share in a moment.

The nice thing about using a spreadsheet is that once the formula has been set up, I rarely have to re-visit it. I wouldn't consider expectancy calculated over trades to be indicative of the success or failure of a trading system.

However, expectancy calculated over trades will be more meaningful.

That's why my trade log includes a way to track my trades over a longer period of time. A trade log is simply a place to record individual trades and measure overall success.

Maturity

You could do this on a piece of paper, in a ledger or other manual process. However, spreadsheets are very well suited for this sort of thing.

There are a lot of interesting things that could be captured with regard to a trade. For this trade log, I prefer to track only information that is useful in giving me a longer term perspective and that can support the various calculations I outlined above. I also capture a short comment where I can note anything special about the trade. Because I use an Excel spreadsheet, all this can be done very simply with a set of formulas.

Worksheet Developing Organisational Values | DIY Committee Guide

For me, it was easier to break the calculations down. First, I calculate total successful trades and total failed trades. To do this, I use a simple Excel formula that essentially counts the number of rows that have a positive value. While it is possible to enter all trades on one page of a spreadsheet, it starts becoming impractical when the number trades tracked gets too large.

When I first set up my trade log, I tracked my trades by quarter. I did this because I typically only made about 50 trades per quarter, which is fairly manageable on a spreadsheet. As my trading volume increases, I moved to tracking trades per month.

Excel supports the ability to have multiple worksheets accessed by tabs at the bottom of the spreadsheet. What I did then was create a worksheet for each month. I labeled each worksheet by the name of the month it tracked. In order to keep a running total of all my important statistics, I now have a separate worksheet that collects that information.

Black Scholes Option Calculator

My formulas get slightly more complicated because not only do I need to specify the cell but also the worksheet. So, for example, here is how I do some of my yearly calculations.

Once I have calculated my yearly totals for total successful trades, total failed trades, average successful gain and average failed loss, I can directly calculate my ratios and expectancy from these numbers without having to reference all the worksheets of the spreadsheet.

To be useful, I've found it is important to be diligent to capture my trades as I enter and exit them. I need to make sure all my trades are captured, including my failures.

I've been tempted in the past to not enter trades I regret making This trade log must be an accurate reflection of my trading against my trading plan. What can it tell me? Back to Option Trading System from Trade Log. Back to Success With Options home. Check out these full length videos that contain lots of specific information about trading spread strategies at an excellent value. I set up and discuss the trades and then follow them up with periodic reviews until they close.

For more detail go to the Options Trading Videos page. Back to Option Trading System from Trade Log Back to Success With Options home. Newsletter Subscription Name Email I keep this private Subscribe now to receive your free promotional package. Video Store Check out these full length videos that contain lots of specific information about trading spread strategies at an excellent value.

Homepage Option Basics Option Strategies Options Brokers Technical Analysis Trading Systems Option Tutorials Options Education Investing Newsletters. Name Email I keep this private Subscribe now to receive your free promotional package.