Vanguard total stock market index capital gains

Expenses Tax distributions Tracking error.

Vanguard Total Stock Market Index Fund tax distributions - Bogleheads

The Vanguard Total Stock Market Index Fund is a very suitable candidate for placement in taxable accounts. The fund is often recommended see Fig. The fund is also one of the underlying fund portfolios for the Vanguard series of Target Retirement Funds and Life Strategy Funds. The table below summarizes the fund's relation to a number of tax factors.

Recently low Qualified dividends: Very Low Stock Migration: The following tables provide long term data on the fund's history of both dividend and capital gains distributions. The first table also provides the historical distribution of qualified dividends. The second table provides a database of the fund's accounting figures: These figures highlight the level of a fund's tax liabilities.

Because both manager turnover of securities inside the portfolio and investor turnover of fund shares can affect the level of gains realization, a third table provides historical turnover ratios.

The following table provides a view of the fund's historical distributions expressed in terms of yields. We can see that the fund distributed modest levels of capital gains during its first decade of existence, a period which coincided with a long bull market. The fund has not distributed a gain since , a period marked by two bear markets, and which saw the introduction of an ETF share class in the fund. Qualified dividends are taxed at lower capital gains tax rates.

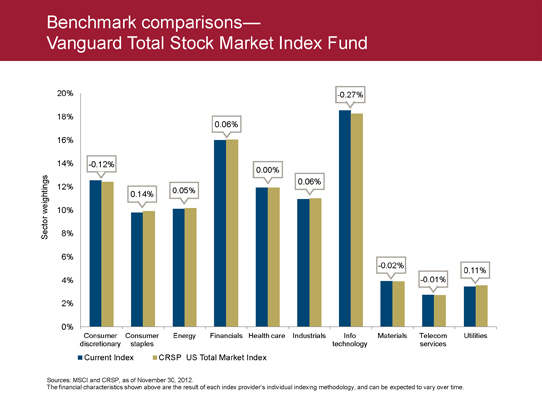

The fund has changed tracking indexes twice in its history. In the table below, the transition year of index change is marked in red. These determining features include:.

The rate at which a fund manager sells securities within the fund has a major effect on potential gains realization. Single digit annual fund turnover percentages result in a low rate of realized gains. Net flows into the fund have the following effects:.

The level of unrealized gains and carryover realized losses in a fund: Any loss carryovers a fund possesses can be used to offset future realized gains carryovers have an eight year expiration period. The third tab on the Table 3.

Mutual fund distributions will be taxed according to the tax laws governing the investment over the holding period of the investment, which are subject to change. The actual tax imposed will depend upon each individual's tax rate and the timing of purchases and sales. The federal tax rates applicable to mutual fund distributions and investor sales of securities for the period onward are outlined below. Keep in mind that investment income may also be subject to state and local taxation.

VTSMX Fund - Vanguard Total Stock Market Index Fund;Investor Overview - MarketWatch

In addition, there is a 3. The annual fund accounting figures show that the Vanguard Total Market Index fund turnover ratio usually stays in single digits. The rise in turnover during fiscal year was due to a shift in the fund's tracking index to the MSCI Broad Market Index. The current tracking index, The CRSP US Total Market Index, being a total market index, can be expected to exhibit low, single digit turnover in future years.

This low turnover can be attributed to the fact that stock migration out of a total market index can come in only two dimensions:. The fund has received net inflows every year of its history. The fund receives, in addition to direct investments, inflows from investors adding to Vanguard Target Retirement and Vanguard Lifestrategy fund of funds.

Assuming continual steady net investment in these retirement accumulation portfolios should result in the continuance of future net inflows into the fund. The period includes the and bear markets. These losses produced loss carryforwards. Low fund and shareholder turnover has retained most of these carryforward losses as offsets to potential future gains. The following table presents the federal tax cost on the fund's historical distributions see second tab, table 6.

The average is based on the results from , the period comprising the qualified dividend tax regime. The average yield is very close to the life of fund average yield.

The fund distributed capital gains during the period, averaging 0. The table does not include the capital gains taxes associated with selling the fund at a gain. A portion of your ordinary dividend may be nonqualified because it can include items like these:. Almost all of the dividends distributed by Equity REITS come in the form of non-qualified dividends.

Non-qualified dividends are taxed at marginal income tax rates.

Vanguard Fund Info Total Stock Market Index Expenses Tax distributions Tracking error Website v t e. EDGAR NSAR filings Turnover statistics: Retrieved 01 November Retrieved from " https: US stock fund distributions. Navigation menu Personal tools Log in. Views Read View source View history. Navigation Wiki home Site navigation News and blogs Acronyms Index Random page. Interaction Recent changes Getting started Editor's reference Sandbox. Tools What links here Related changes Special pages Permanent link Page information.

This page was last modified on 20 June , at Content is available under GNU Free Documentation License unless otherwise noted.

Total Stock Market Indexes ✔ Stock MarketClick for complete Disclaimer. Expenses Tax distributions Tracking error Website. Fund distributions Distribution methodology. Vanguard SEC filings EDGAR. Dividend Investor shares [1]. Dividend Admiral shares [1].

Vanguard - The Vanguard Group

Dividend ETF shares [1]. Short-term Capital Gains [2]. Long-term Capital Gains [2] [notes 1]. FY Annual Return - Investor [4].

Realized losses can be used to offset realized gains in an attempt to reduce taxable gains. If realized losses are higher than realized gains, a fund can "carry forward" these excess losses to offset future gains. In-kind redemption gains are included as gains in this statistic. Distributed gains A net realized gain will be distributed to shareholders as a capital gains distribution.

Funds with low turnover rates, such as index funds, tend to have more unrealized gains than actively managed funds and are less likely to pass taxable gains on to investors.

A fund's unrealized appreciation or depreciation figures are valuable because they can give an idea of whether a fund would need to distribute any gains if all of its securities were sold.

Such information may help you determine your potential exposure to taxable distributions. This statistic is volatile, and will increase or decrease depending on market returns. In-kind redemptions Instead of selling securities, a portfolio manager may elect to distribute securities in-kind to redeeming shareholders.

Unlike a sale, an in-kind transfer is not taxable. For institutional redemptions, a portfolio manager can select low-basis securities to transfer removing the embedded tax liability from the portfolio.

Vanguard Total Stock Market Index Fund Admiral Shares - renyropebow.web.fc2.com

Average net assets Average net assets are derived from NSAR reports from the EDGAR database. Redemptions The dollar amount of fund shares sold by shareholders. Sales The dollar amount of fund shares bought by shareholders. Turnover The rate at which the fund manager sells securities within the portfolio. The reciprocal of this number reflects the average holding period of the portfolio.

Low turnover often results in low capital gains realization. It is analogous to the investment manager's turnover ratio. A ratio of less than 1 means that investors are net purchasers of the fund. A ratio more than one means investors are net sellers of the fund.