Put option bull spread

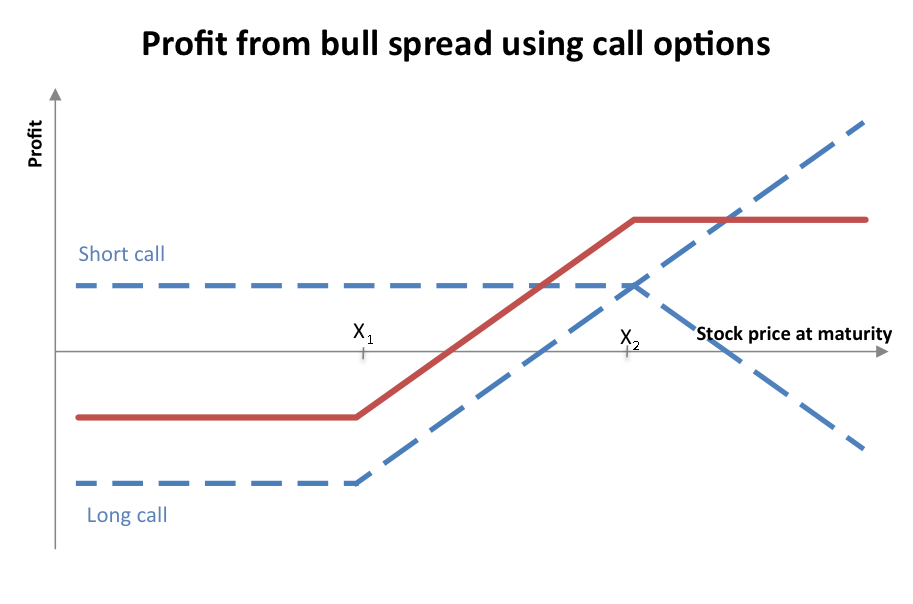

A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset.

Bull spread - Wikipedia

This strategy is constructed by purchasing one put option while simultaneously selling another put option with a higher strike price. The goal of this strategy is realized when the price of the underlying stays above the higher strike price, which causes the short option to expire worthless, resulting in the trader keeping the premium. Additionally, if exercising the long put option is favorable, the investor has the right to sell the underlying stock at the lower strike price.

This type of strategy buying one option and selling another with a higher strike price is known as a credit spread , because the amount received by selling the put option with a higher strike is more than enough to cover the cost of purchasing the put with the lower strike. The bull put spread strategy has limited risk, but it has a limited profit potential. Investors who are bullish on an underlying stock could use a bull put spread to generate income with limited downside.

The maximum possible profit using this strategy is equal to the difference between the amount received from the short put and the amount used to pay for the long put. The maximum loss a trader can incur when using this strategy is equal to the difference between the strike prices and the net credit received.

Bull put spreads can be created with in-the-money or out-of-the-money put options, all with the same expiration date. Assume an investor is bullish on hypothetical stock TJM over the next two weeks, but the investor does not have enough capital to purchase shares of the stock. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Bull Put Spread Explained | Online Option Trading Guide

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Bull Put Spread Share. What is a 'Bull Put Spread' A bull put spread is an options strategy that is used when the investor expects a moderate rise in the price of the underlying asset.

Money A2Z

Profit and Loss The bull put spread strategy has limited risk, but it has a limited profit potential. Bull Put Spread Example Assume an investor is bullish on hypothetical stock TJM over the next two weeks, but the investor does not have enough capital to purchase shares of the stock. Bull Call Spread Bear Put Spread Bull Spread Short Put Bear Call Spread Long Leg Horizontal Spread Married Put In The Money.

Bull Put Spread

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Bull Put Spread Option StrategyGet Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.