Livingsocial employee stock options

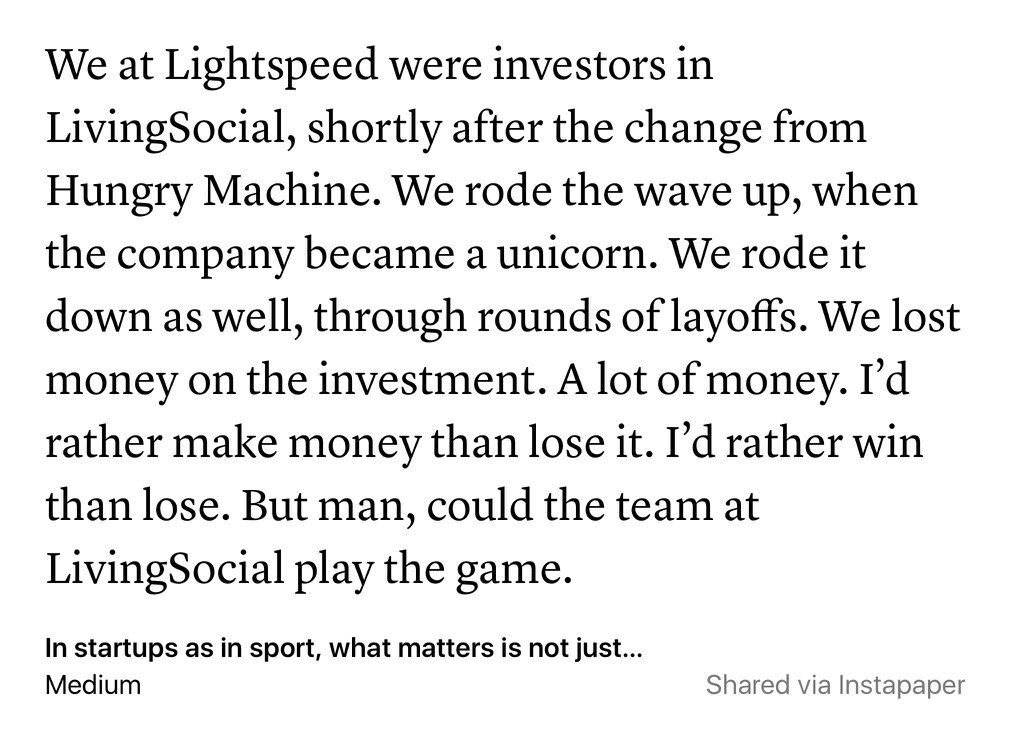

Fortune has obtained LivingSocial's charter filing for this investment with the state of Delaware, which demonstrates that the PrivCo report was wrong on at least some portions of the deal.

Employee Stock Options: Core Aspects To KnowWhere PrivCo stated that no equity or stock was part of the deal, Fortune reports that the charter shows that stock was issued. The charter filing also shows that PrivCo was wrong on the form of dividend investors would receive, according to Fortune.

The deal was meant to save the daily deals giant from "imminent financial ruin," PrivCo claims, with the hope that the company can be kept alive long enough to be sold at the end of The allegedly "oppressive" agreement, its low valuation of the stock, and repricing of previous shares don't bode well for LivingSocial employees, according to PrivCo:.

In the PrivCo report, PrivCo CEO Sam Hamadeh claims that LivingSocial was days away from "a total collapse of their company. Additional Resources Best Of D.

Do This Sponsored Content Deals Promotions Events Downtown Holiday Market Guide Camp Guide User Tools Subscribe Login Register Logout ETC LivingSocial Was "Just Days from Bankruptcy," Employee Stock Options "Worthless".

Feb 21, 5 PM. The allegedly "oppressive" agreement, its low valuation of the stock, and repricing of previous shares don't bode well for LivingSocial employees, according to PrivCo: Photo by Darrow Montgomery.

PrivCo | (PrivCo EXCLUSIVE): LIVINGSOCIAL Receives Emergency $M Debt ("Equity" In Name Only) Infusion From Existing Investors With Oppressive Terms, JUST DAYS FROM BANKRUPTCY, Effectively Handing Over Distressed Co. to Today's Financing ParticipantsImplied Valuation Incl All Req'd Payments: JUST $M, DOWN 94% FROM $ BILLION In Dec. V.C. RoundPure Equity Was NOT Issued Today (As Has Been Widely Misreported)Instead, A Desperate LIVINGSOCIAL Accepted A COMPLEX Series of Secured-Convertible-Debt-Like Securities With Onerous Terms (PrivCo Has Confirmed Exclusively) Including: (1) Liquidation Preferences of SEVERAL TIMES the $M In Debt (2) Mandatory Cash Dividends Due (3) "Super-Warrants" And/Or Large Lump-Sum Cash "Elimination" Payment, (4) Secured Against Co. Assets and Stock, (5) Repayment of the $M "Loan" in 4 Yrs w Add'l Payments, and (6) Re-Pricing of Participating Investors Earlier RoundsEmployees' and Founders' Common Stock Now Worthless

City Dismantles NoMa Homeless Encampment. School Throws Students the Prom of a Lifetime.

After Pushback, Bisnow Cancels Discussion on 'The Future of Southeast D.