How to transfer privately held stock

Home Legal Answers Business Law Corporations Transfer of shares. Refer to our Disclaimer regarding permitted use of this site. If you would like to contact government and agency offices relating to this area of law, or review applicable legislation for yourself, click here.

Legal Line provides legal information only. If you want to hire an expert to give you advice on this exact issue, please refer to the professionals that appear below this topic. Most small corporations and family run corporations are privately held.

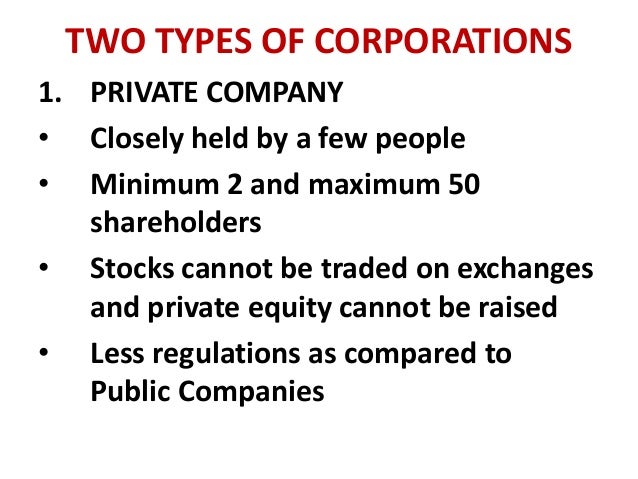

Private corporations are those corporations that have 50 shareholders or less and whose shares are not offered to the public. Buying or selling shares in a public corporation is not discussed here. Here we will discuss the transfer of shares in privately held corporations. One of the benefits of the corporate form of business is that the ownership of the corporation can be easily transferred by the purchase and sale of shares.

If shareholders of a privately held corporation do not want to own a part of the corporation any longer, their shares can be sold to someone else including another corporation or a partnership.

If a shareholder wants to income split with family members for tax purposes, he or she will be able to do so by transferring their shares. If you are an owner of a privately held corporation and you want to sell or transfer your ownership, there are several things to consider.

5 Things You Should Know About Giving Stock to Charity

Before you transfer or sell shares, you must make sure that you follow any rules that are set out in the Articles of Incorporation and in the corporate by-laws. There may be restrictions on who can buy or sell shares, or on how many shares can be transferred.

For a privately owned corporation, the Articles of Incorporation usually require that the other shareholders agree to the transfer of shares. It is also common that the shareholders of the corporation will have to pass a resolution that approves the transfer of shares.

This is often the case because with most privately held corporations, the shareholders also act as directors and officers of the company, and they want to have a say about who they are going to do business with and work with. You should review the Articles of Incorporation, or contact a lawyer to help you determine what restrictions apply to your situation.

Also before selling or buying shares, the price will have to be determined. Unlike the shares of a public corporation where the price is determined in the stock market and readily available to the public, the price of shares for a privately held corporation is determined by the shareholders.

There is no one formula for determining the price of shares. If you have a shareholders agreement, the formula to be used for your corporation may be found there. If no formula or price has been put in place, you should consult a lawyer, a business valuator or an accountant for help. Transferring shares does not change or nullify the legal structure of the corporation. However, in many privately held corporations, the owners of the corporation also take an active role in running the day-to-day affairs of the business, and if a shareholder leaves the business, then there may be some significant changes in the way that the business is run.

Also, there will be tax implications when transferring shares. If the shares qualify as qualified small business corporation shares , the seller will be able to take advantage of any unused portion of the lifetime capital gain exemption LCGE. The increased limit applies to all individuals, even those who have previously used the LCGE. Ontario Business Law Choosing a Form of Business Choosing a form of business and becoming self-employed Sole Proprietorships What is a sole proprietorship?

This Website provides legal information and referrals.

For legal advice, contact a lawyer. User Account Legal Answers Find Professional Help. Select a Province Alberta British Columbia Manitoba New Brunswick Newfoundland Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon.

Ontario Business Law Choosing a Form of Business Ontario Area of Law: Business Law Answer Number: Transfer of shares Region: Restrictions on the transfer of shares Before you transfer or sell shares, you must make sure that you follow any rules that are set out in the Articles of Incorporation and in the corporate by-laws.

Lifetime capital gains exemption Also, there will be tax implications when transferring shares. Before you buy or sell shares of a privately held corporation, you should consult a lawyer. Each situation is unique. Get the solution that's right for you.

Transfer of shares - Legal Line

Select as many as apply Incorporations. Buying and Selling a Business. Initial Public Offerings IPOs. I have read and agree to the terms set out in the disclaimer. Was your question answered?

Connect Facebook Twitter Linkedin. Free app coming soon.