Forex market structure and functions

My Trading System - 1: Forex market structure, function and timings /10th Anniversary Series

This article is a topic within the subject Capital Markets and Institutions. Viney, Financial Institutions, Instruments and Markets , 6th Edition: Each country or monetary union is responsible for determining their exchange rate regime.

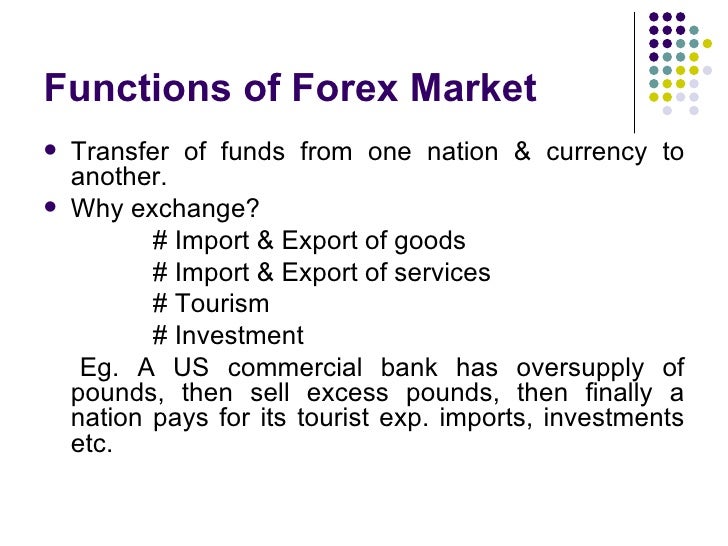

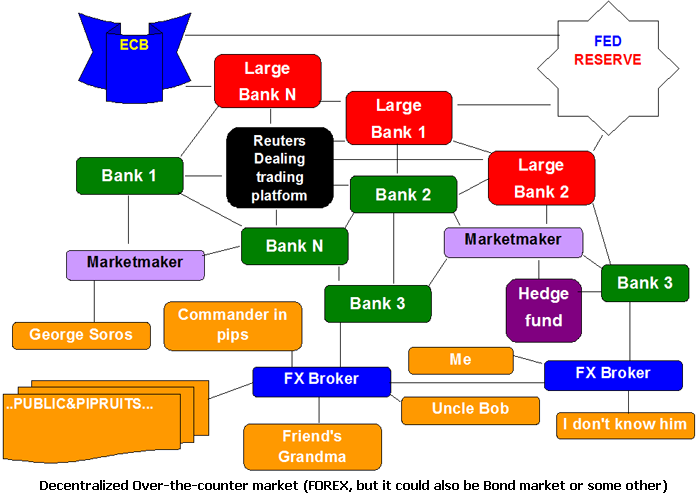

An exchange rate is the value of 1 currency relative to that of another currency. It comprises all financial transactions denominated in foreign currency. FX is usually part of a banks treasury operation dealing room.

Spot transactions have a maturity date 2 days after the contract is entered into, whilst forward transactions have value date in excess of 2 days.

The price of a currency must be expressed in terms of another currency. Originally, the dealer would give sell 1. Originally, the dealer would sell 1 EUR to get buy 1. The dealer bids 1. To put it simply, the original bid refers to the rate at which the dealer would buy the base currency and sell the terms currency. Thus the original bid is the offer rate when the original terms currency is transposed to become the base currency. All currencies are quoted against the USD. When FX transactions take place between 2 currencies, with neither being USD, a cross rate is calculated.

Transpose one of the direct quotations whilst aligning the correct base currency to what is required to get a direct and an indirect quotation.

Then you can simply multiply bid with bid and offer with offer. This can be seen in the below example.

Forex Trading online +++ compare the best FX brokers +++ Lowest spreads +++ no deposit bonus

Multiple bid with bid and offer with offer. Transpose one of the indirect quotations the exact one depends on the question - you must make sure the base currency is first.

Forex Market Structure - renyropebow.web.fc2.com

Then multiply bid with bid and offer with offer. The forward exchange rate varies from the spot rate owing to interest rate parity. Interest rate parity is the principle that exchange rates will adjust to reflect interest rate differentials between countries.

Forward exchange rates are quoted as forward points either above or below the spot rate. Forward points represent the forward exchange rate variation to a spot rate base. This following 2 examples demonstrate the knowledge required for this course. Forward exchange rate contracts lock in an exchange rate today for delivery at a specified future date.

FX dealers quote forward points on standard delivery dates, usually monthly, out to 12 months of a specified amount of currency against another.

This is the end of this topic. Click here to go back to the main subject page for Capital Markets and Institutions. Textbook refers to Viney, Financial Institutions, Instruments and Markets , 6th Edition: Retrieved from " http: Capital Markets and Institutions.

Personal tools Create account Log in Log in with Facebook. Views Read View source View history. Navigation Main page Forums About us Contribute Contact us Help. Toolbox What links here Related changes Special pages Printable version Permanent link WikiForum. This page was last modified on 12 December , at This page has been accessed 12, times. Privacy policy About Uni Study Guides Disclaimers.