Preferred stocks below par

Buy These 3 Underpriced High Yield Preferred Stocks

This Dividend Has Grown Ten-Times Bigger in Ten Years. Truth is, most dividend stocks just don't cut it. But we've found one stock that pays dividends so big -- you can live off them.

This cash-cranking company has a history of raising its dividend quarter after quarter.

22. What is Preferred StockIn fact, it's hiked its dividend FOLD! If these ever-increasing payouts sound good to you -- Click here to read my full report on this and two more high yield stocks -- so you can secure this reliable stream of income for yourself.

Call Us FAQs Contact. Reading Now Buy These 3 Underpriced High Yield Preferred Stocks.

Access to this page has been denied.

Events Training Videos Free Reports Premium Research About Editors Contact Us Subscriber Login. Buy These 3 Underpriced High Yield Preferred Stocks Lawrence Meyers November 07, at One of the great unsung heroes in the stock market, and in my portfolio, are preferred stocks. These stock-bond hybrids offer high-yields , stability, and replaced low-yielding bonds during this period of historically low interest rates.

Buy and Hold This Dividend Stock Forever

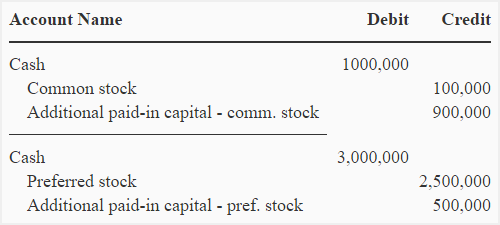

Preferred stock is a cross between and a bond and a stock. A bond is a loan where the investor gets an interest payment in exchange for the loan.

Par value stock - Accounting For Management

Debt always has the highest position for recovery of principal if the company files for bankruptcy. Preferred stocks allow a company to raise money without diluting the ownership of other shareholders, while also allowing current bondholders to maintain their position in the capital stack.

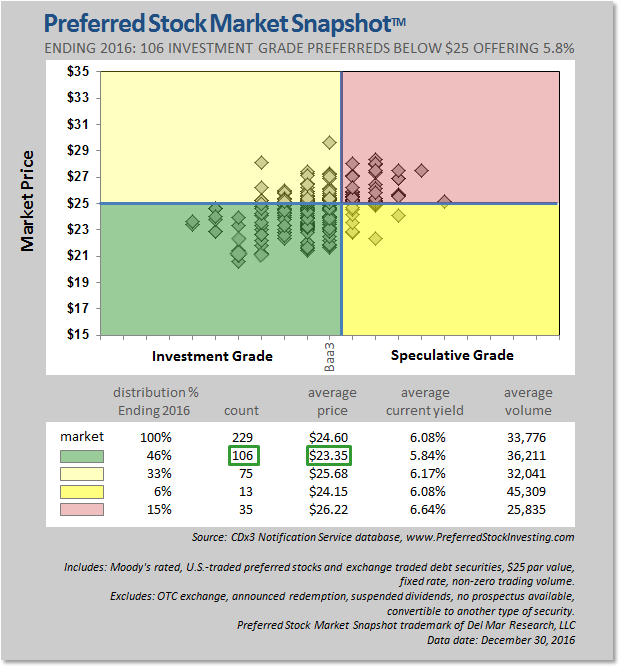

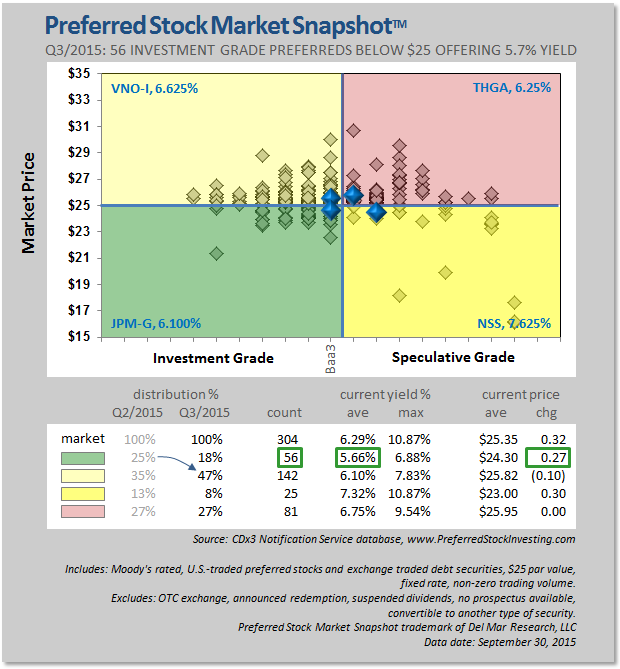

So preferred stock fits right in between common stock and bonds. However, the market has inefficiencies and you have an opportunity to pick up these three preferred stocks trading below par, which means you have the chance for capital gains as well as a good dividend.

Stock symbols for preferred stocks vary by broker. Bank of America NYSE: BAC is hardly the teetering giant it was during the financial crisis. It is a rock-solid bank with a massive mortgage servicing business.

It is in no solvency danger whatsoever. I think the stock is this far below par because its yield is lower than most preferred issuances. The yield is tied to the greater of LIBOR plus 0. Investors are choosing higher-yielding, fixed-rate dividends instead.

However, because it sells below par the yield is 4. The same situation exists with one of my other favorite banks, U. US Bank remains one of the most conservative and stable banks in the nation, which had very little exposure to toxic mortgage assets. There is no downside to buying here. PCG has a 4. Consequently, the yield has risen to 5.

Investors seem to be nervous over potential liability from a natural gas pipeline explosion which has already been assessed , and the investment of hundreds of billions of dollars over the next 30 years to upgrade its transmission systems. There seems to be little cause for the fear in the preferred, which pays that 5.

I think concern over the upgrade expense is overblown. Published by Wyatt Investment Research at www. Ridiculously Undervalued Company Could Deliver a Huge Special Dividend Stephen Mauzy.

Latest My Favorite Options Strategy for the Summer Months Andy Crowder Options. Ian Wyatt Best Dividends.

Symbols APPL AMZN FB EBAY NFLX XOM SBUX HAL MCD. About Us About Us Testimonials Careers Privacy Policy Email Policy Terms of Use Compensation Disclosure. Publications Personal Wealth Advisor High Yield Wealth Million Dollar Portfolio High Yield Trader Dividend Confidential Options Advantage Momentum Trade Alerts. Social Twitter Facebook Google Plus LinkedIn YouTube RSS.

Copyright Wyatt Invesment Research.