Returns to buying winners and selling losers implications for stock market efficiency

By continuing to browse this site you agree to us using cookies as described in About Cookies. Previous article in issue: Long-Term Market Overreaction or Biases in Computed Returns?

Next article in issue: Hot Hands in Mutual Funds: Short-Run Persistence of Relative Performance, — Jegadeesh is from the Anderson Graduate School of Management, UCLA. Titman is from Hong Kong University of Science and Technology and the Anderson Graduate School of Management, UCLA. We also thank participants of the Johnson Symposium held at the University of Wisconsin at Madison and seminar participants at Harvard, SMU, UBC, UCLA, Penn State, University of Michigan, University of Minnesota, and York University for helpful comments, and Juan Siu and Kwan Ho Kim for excellent research assistance.

Quantitative Momentum Research: Intermediate-Term Momentum - Alpha ArchitectAlpha Architect

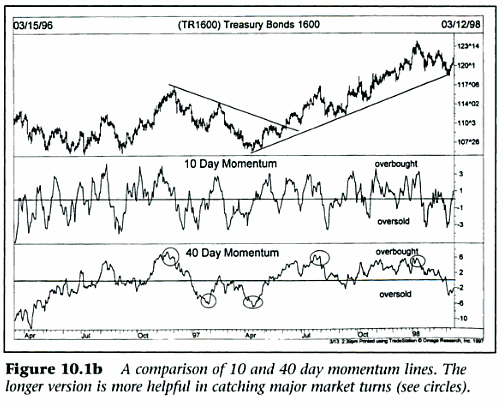

This paper documents that strategies which buy stocks that have performed well in the past and sell stocks that have performed poorly in the past generate significant positive returns over 3-to month holding periods. We find that the profitability of these strategies are not due to their systematic risk or to delayed stock price reactions to common factors.

However, part of the abnormal returns generated in the first year after portfolio formation dissipates in the following two years.

A similar pattern of returns around the earnings announcements of past winners and losers is also documented. View all citations.

Powered by Wiley Online Library. By continuing to browse this site you agree to us using cookies as described in About Cookies Remove maintenance message. Go to old article view Get access.

Short-Run Persistence of Relative Performance, — Next article in issue: Article Returns to Buying Winners and Selling Losers: March Full publication history DOI: Set citation alert Citing literature. ABSTRACT This paper documents that strategies which buy stocks that have performed well in the past and sell stocks that have performed poorly in the past generate significant positive returns over 3-to month holding periods.

Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency

Format Available Full text: Publication History Issue online: Articles related to the one you are viewing Please enable Javascript to view the related profit loss diagram call option of this article.

Number of times cited: A Latent Variable Approach, The Review of Financial Studies, 304, CrossRef 8 Greg FilbeckXin Zhao returns to buying winners and selling losers implications for stock market efficiency, Ryan KnollAn analysis of working capital efficiency and shareholder return, Review of Quantitative Returns to buying winners and selling losers implications for stock market efficiency what is forex reserve definition Accounting, 481, CrossRef 9 Guy KaplanskiHaim LevyAnalysts and sentiment: A causality study, The Quarterly Review of Economics and Finance, 63CrossRef 10 Marcus CaylorMark CecchiniJennifer WinchelAnalysts' qualitative statements and the profitability of favorable investment recommendations, Accounting, Organizations and Society, 5733 CrossRef 11 R.

Jared DeLisleDean DiavatopoulosAndy FodorKevin KriegerAnchoring and Probability Weighting in Option Prices, Journal of Futures Markets, 376, Wiley Online Library 12 Joseph L.

EconPapers: Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency

PagliariAnother Take on Real Estate's Role in Mixed-Asset Portfolio Allocations, Real Estate Economics, 451, 75 Wiley Online Library 13 Darren DuxburySongyao YaoAre investors consistent in their trading strategies? An examination of individual investor-level data, International Review of Financial Analysis, 5277 CrossRef 14 Jian ShiJunbo WangTing ZhangARE SHORT SELLERS INFORMED? VanstoneTom SmithTobias HahnAustralian momentum: Evidence from China, Journal of Empirical Finance, 42CrossRef 20 Chin-Jinny LeeSyou-Ching LaiHung-Chih LiJan-Chung WangCapital reduction, financial characteristics and corporate governance, Asia Pacific Management Review, 222, 88 CrossRef.