Trading gasoline futures

Commodity futures offer investors a way to leverage their accounts for maximum impact — as well as a chance to diversify easily and affordably and take advantage of liquidity. Gasoline futures are some of the most hotly-traded futures in the market; indeed, at times futures values can actually influence the price of gasoline in the market.

Investors purchase gasoline futures to wager on how much they expect the price of gasoline to be at some predetermined time in the future. Since you can control large amounts of a commodity with a relatively small amount of money on margin, you can leverage your portfolio to take advantage of price swings in the commodity without having to actually take delivery of thousands of gallons of gasoline — something that is impractical for everyone other than institutions such as refiners, airlines, transportation fleets, gasoline retailers, etc.

This is the abbreviation for the New York Harbor RBOB Gasoline futures, sold at the New York Mercantile Exchange NYMEX. They are also called NYMEX Gasoline Futures. E-mini Contracts Availability and Volume: E-mini gasoline futures contracts are available; these smaller contracts are for 21, gallons and are listed for 12 consecutive months as opposed to 36 consecutive months for larger contracts.

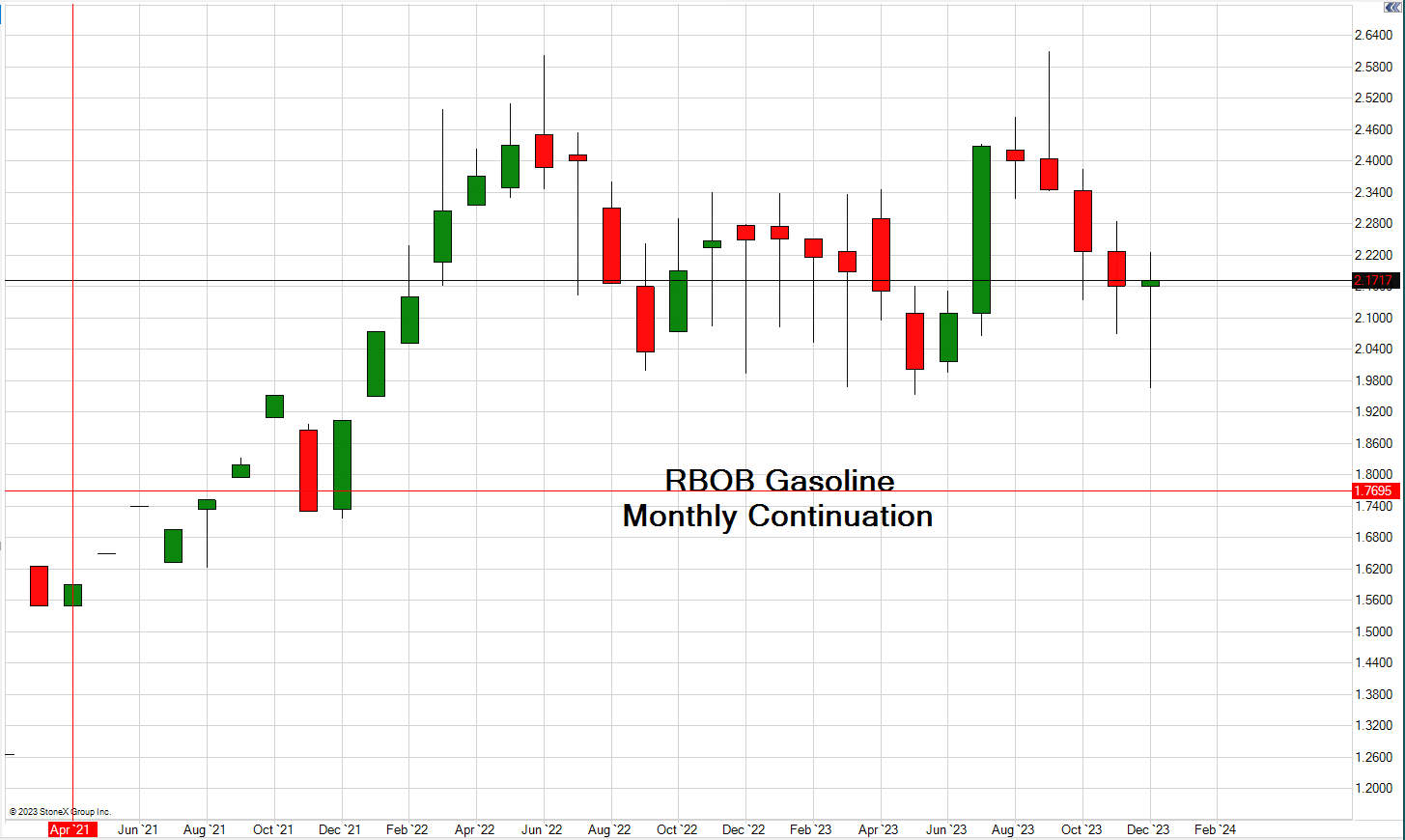

The symbol is QU. Unleaded gasoline futures, historically, have been on the rise. Comparison can be tricky, though, because the format for reporting RBOB prices changed in This came about because of a change in the composition of the gasoline itself.

RBOB Gasoline Futures Quotes - CME Group

Gasoline formerly was leaded; then, it became unleaded and began trading on NYMEX in Starting in October, , though, the new standard became RBOB — which stands for Reformulated Blendstock for Oxygenate Blending.

So, from onward, prices are given in RBOB and are expressed in terms of dollars and cents per gallon. If you go back further, you can see a dip in gasoline futures that coincided with the recession from to This comparison explains one pricing factor in play with gasoline futures: Gasoline futures dropped in and because the global economy went into a recession.

Consumers had less to spend, primarily because unemployment spiked and business as a whole dropped. Thus, consumers — the primary users of gasoline — drove less. They took vacations and relocated closer to work to create shorter commutes. From a commercial standpoint, distributors had fewer orders to process, so their truck fleets drove less on average. All of this contributed to a rare global reduction in the consumption of gasoline, which did not regain its footing until This can be seen in a price chart for gasoline in Nevada:.

Expected consumption, then, is probably the biggest single factor in the price of gasoline.

Online RBOB Gasoline Futures (RB) Trading at optionsXpress

According to the U. Pay close attention to supply and demand for crude oil.

China has been one of the fastest-growing consumers of oil in the world for the past half-decade. China and other Asian consumers are purchasing as much spare petroleum as possible, which will steadily drive up the price of petroleum barring some unforeseen technological breakthrough or global slowdown.

The supply and demand curves for crude oil play a major role in expected gasoline values — and, as a result, gasoline futures in general. You can use these tags: Currently you have JavaScript disabled.

In order to post comments, please make sure JavaScript and Cookies are enabled, and reload the page. Click here for instructions on how to enable JavaScript in your browser. Enter your E-Mail to recieve updates. Home Stock Tutorials Stock Brokers Reviews Optionshouse Review TradeKing Review TD Ameritrade Review ETrade Review Scottrade Review Penny Stock Brokers Binary Options Brokers Contact More..

Gasoline Futures Trading Basics | The Options & Futures Guide

OptionsXpress Review Alternative Investments About. Gasoline Futures Tweet Tweet Commodity futures offer investors a way to leverage their accounts for maximum impact — as well as a chance to diversify easily and affordably and take advantage of liquidity.

Be the first to leave a reply! Leave a Reply Click here to cancel reply. Popular Posts How To Trade Stocks - The Basics Top Online Stock Brokers A Guide to Finding High Dividend Stocks The Ultimate Guide To Stock Screeners The Basic Guide To Chart Patterns Simulated Stock Trading Stock Trading Strategies. I'm Karl and I have been a keen investor for over a decade. Learn more about my experiences and say hello!